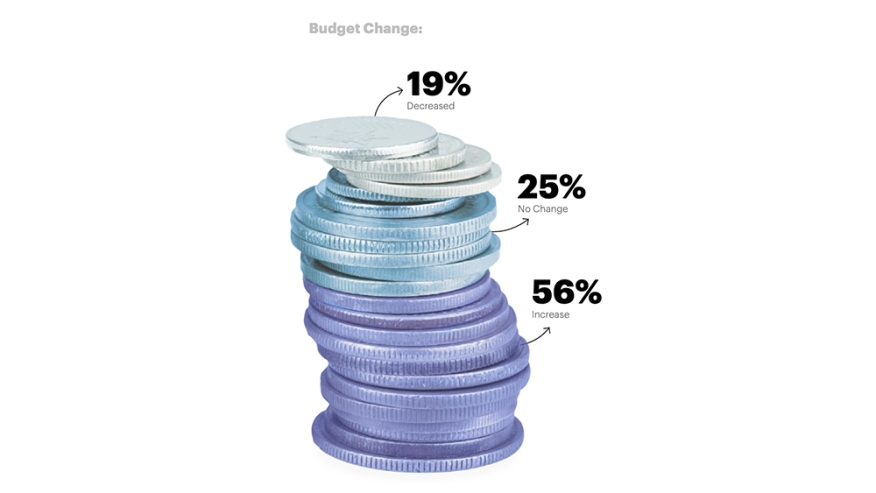

Cyber Budgets Up Amidst Economic Uncertainty

Despite being in a period of economic slowdown, 56 percent of survey respondents reported an increase in their cybersecurity budget from 2022. This data aligns with the global trend that cybersecurity spending has not been significantly impacted by recent geopolitical and economic challenges, as expected, as cyber threats continue accelerating.

Among the CISOs reporting budget decreases the majority of these cuts were observed in larger companies with over 100 cybersecurity employees and budgets exceeding $10 million.

Speaking on the centrality of cybersecurity in an enterprise’s strategy in 2023, Admiral Mike Rogers, former director of the NSA and operating partner at Team8 said, “In a world rife with economic and geopolitical challenges, cybersecurity takes center stage as enterprises recognize the critical necessity of increasing investment in robust defense measures to protect their most valuable assets.”

Where should It Be Allocated?

Survey results revealed that Identity and Access Management (IAM) and cloud security are the top categories for anticipated budget expansion. With the accelerated adoption of cloud technologies and remote work trends, CISOs seek to enhance their cybersecurity posture by investing in robust IAM and cloud security solutions.

David Cross, senior vice president, CISO SaaS Cloud Security at Oracle, added on why Cloud Security budgets are expected to increase, saying that “Businesses are rapidly migrating their data and applications to the cloud to take advantage of the innovation and security benefits that are difficult to achieve in on-premise environments. They are equally seeking out cloud security best practices, technologies, and solutions to assist in this transition from the traditional data center skills, experiences, and processes.”