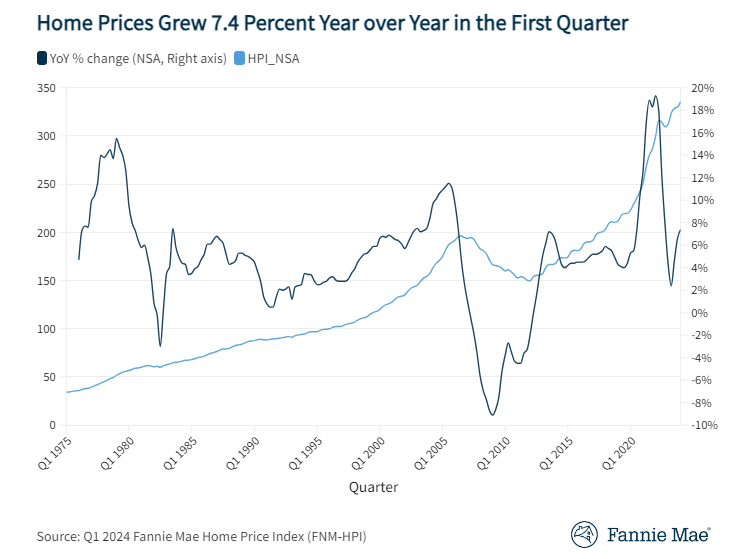

Fannie Mae: Home Prices See YOY Increases

Quarterly, home prices rose a seasonally adjusted 1.7% in Q1 2024, essentially the same as the growth in Q4 2023.

Single-family home prices increased 7.4% from Q1 2023 to Q1 2024, up from the previous quarter's revised annual growth rate of 6.6%, according to Fannie Mae's latest Home Price Index (FNM-HPI) reading.

The reading measures the average, quarterly price change for all single-family properties in the United States, excluding condos. The FNM-HPI is produced by aggregating county-level data to create both seasonally adjusted and non-seasonally adjusted national indices that are representative of the whole country and designed to serve as indicators of general single-family home price trends.

Quarterly, home prices rose a seasonally adjusted 1.7% in Q1 2024, essentially the same as the growth in Q4 2023. On a non-seasonally adjusted basis, home prices also increased by 1.7% in Q1 2024.

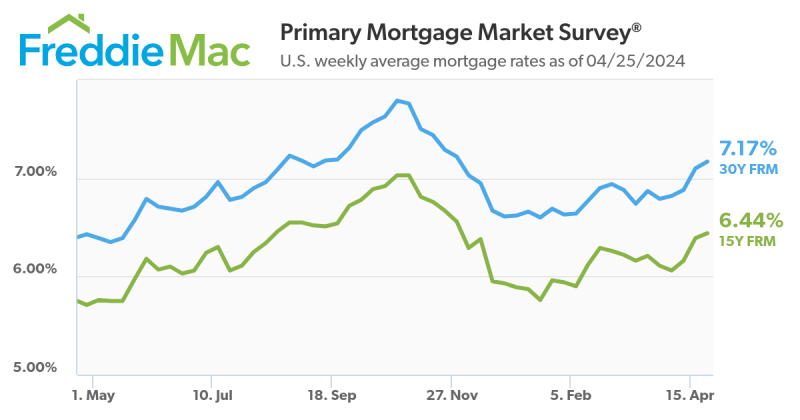

"Home prices continued to rise in the first quarter as the housing market remained seriously supply constrained," said Fannie Mae Senior Vice President and Chief Economist, Doug Duncan. "The stabilization of mortgage rates in the 6.6% to 6.7% range in January helped to boost demand early in the first quarter, with existing home sales and mortgage applications both rising. Mortgage rates have trended upward again of late, but there is support for home prices in strong demographic demand from younger generations. We expect home sales to rise modestly this year as potential homebuyers appear to be acclimating to the higher-rate environment and, in some cases, may be less able to put off moving for life reasons."