NMP’s 2016 Mortgage Technology Providers Directory

Best Rate Referrals

Best Rate Referrals

(800) 811-1402 ♦ BestRateReferrals.com

Why techies love the company: We seamlessly integrate marketing campaigns into lender's LMS and CRM systems.

Why clients love the company: High-quality mortgage marketing campaigns managed with first-class service.

Description of products/services offered: Best Rate Referrals has been specializing in high converting marketing campaigns since 2005. Their experienced marketing consultants can help develop campaigns that target consumers who qualify for a variety of loan programs. Best Rate Referrals specializes in lead generation and offers real-time Internet leads, live transfers via its in-house call center, direct mail campaigns and various types of aged leads and data lists.

Class Appraisal

Class Appraisal

(866) 333-8311 ♦ ClassAppraisal.com

Why techies love the company: Class Appraisal is building proprietary resources that no one else in the industry has.

Why clients love the company: Class Appraisal builds a strong relationship with its clients and offers them the best results.

Description of products/services offered: Class Appraisal is a nationwide appraisal management company (AMC) specializing in exceptional service, fast turn times, and a customized platform built to meet each client's individual needs. Class Appraisal works with many of the top wholesale lenders, retail lenders and credit unions in the country.

DocMagic

DocMagic

(800) 649-1362 ♦ DocMagic.com

Why techies love the company: DocMagic’s Tech Center features security, processing power, scalability and storage capacity.

Why clients love the company: The highest levels of innovation, customer service and compliance expertise.

Description of products/services offered: As the largest provider of end-to-end document preparation solutions for the mortgage industry, DocMagic provides products and eservice solutions for more than 10,000 customers, nationwide. With SmartCLOSE, the company’s TRID-compliant and award-winning collaborative closing portal, DocMagic has solidified its reputation for innovation, quality, service and trust. Dedicated to providing the technology for survival in today's complex regulatory environment, DocMagic ensures its customers work smarter, not harder.

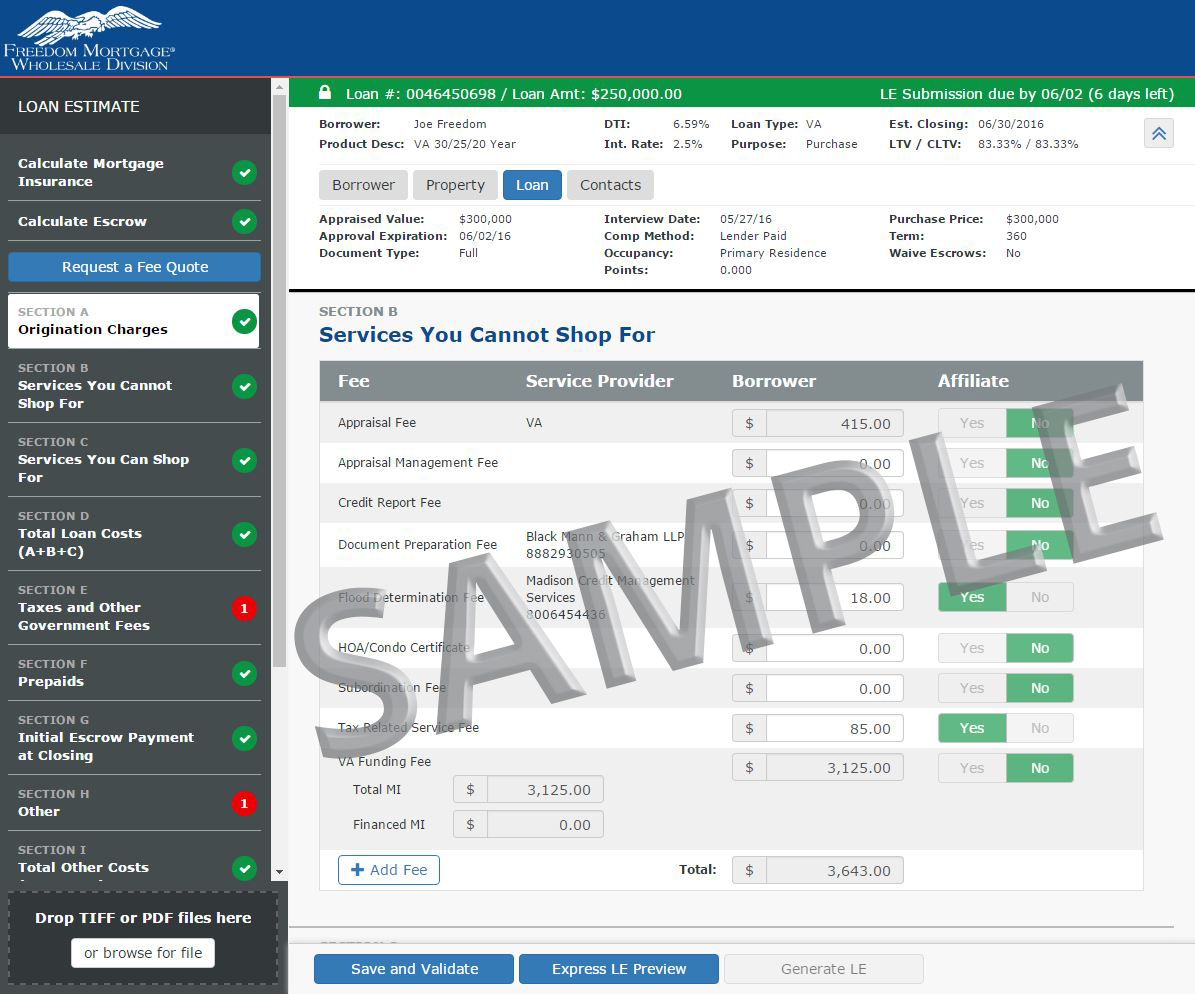

Freedom Mortgage

Freedom Mortgage

(800) 388-1537 ♦ FreedomWholesale.com

Why techies love you: Freedom Mortgage is evolving. The company’s new Web site is designed for a higher-quality experience.

Why clients love the company: Service excellence. Soon, customers will be able to submit their LE in less time with Freedom’s upgraded tool.

Description of products/services offered: Ranked as the number three wholesale lender nationwide by Inside Mortgage Finance (2015), Freedom Mortgage Wholesale has an experienced team of wholesale AEs and industry professionals committed to each client’s success. Freedom Mortgage offers competitive products and pricing, best-in-class service, consistent and relevant industry training and a recently enhanced, real-time online portal to manage pipelines and reporting. Freedom Mortgage Wholesale offers a wide range of products to meet your needs, conventional, FHA, VA, USDA, Jumbo, HARP and more. Choose Freedom to Grow.

Global DMS

Global DMS

(877) 866-2747 ♦ GlobalDMS.com

Why techies love you: Global DMS offers the most robust valuation platform with best-of-breed integrations.

Why clients love the company: Global DMS' eTrac system provides comprehensive and complaint automated workflow.

Description of products/services offered: Global DMS provides commercial and residential real estate valuation technology solutions. The company’s solution set is cost-effectively delivered on a Software-as-a-Service (SaaS) transactional basis that ensures compliance adherence, reduces costs, increases efficiencies and expedites the entire real estate appraisal process. The company’s solutions include its eTrac valuation management platform, eTrac Web Forms, Global Kinex, AVMs and data analytics products, the MISMO Appraisal Review System (MARS), ATOM (Appraisal Tracking On Mobile) and AMCmatch.com.

Indecomm Global Services

Indecomm Global Services

(214) 515-0848 ♦ Indecomm.net

Why techies love you: Indecomm Global Services is unmatched in applying original technology to mortgage issues.

Why clients love the company: Indecomm’s products are innovative, easy-to-use and backed by exemplary service.

Description of products/services offered: As both a technology company and a provider of outsourced mortgage services, Indecomm marries advanced technology with the current challenges of the mortgage industry. The result is a robust set of proprietary platforms in risk management, income calculation and analysis, document management, post-closing, and learning management, as well as title preparation and eRecording.

Land Home Financial Services Inc.

Land Home Financial Services Inc.

(800) 398-0865 ♦ [email protected]

Why techies love you: eXPRESS registration, pricing and locking portal, and a 21-day purchase guarantee.

Why clients love the company: Experienced professionals dedicated to closing the loan transaction on time.

Description of products/services offered: Land Home Financial is a full-service mortgage banker that has been in business since 1988 that is approved in 49 states and D.C. with FNMA, FHLMC and GNMA S/S approvals. Land Home Financial has a knowledgeable, experienced purchase money-centric sales and operations culture. The company offers the NHF Sapphire DPA program nationwide, full-service reverse mortgages and expanded non-QM products. Land Home Financial is a national third-party origination platform with a correspondent release coming soon!

Mortgage Capital Trading Inc. (MCT)

Mortgage Capital Trading Inc. (MCT)

(619) 543-5111 ♦ MCT-Trading.com

Why techies love you: Robust, real-time hedging and best-execution secondary marketing platform.

Why clients love the company: Combines hands-on trading support with comprehensive secondary technology.

Description of products/services offered: MCTlive! is a comprehensive capital markets platform focused on empowering secondary marketing performance for lenders to increase profitability while carefully managing risk. Robust functionality in the browser-based software facilitates pipeline management, trade management, hedging, best execution, pull-through analytics, scenario modeling, and much more.

MCT’s unique offering lets clients choose their level of autonomy, combining software with full-service secondary marketing guidance. This award-winning technology was designed by secondary for secondary, but the benefits don’t stop at the secondary department!

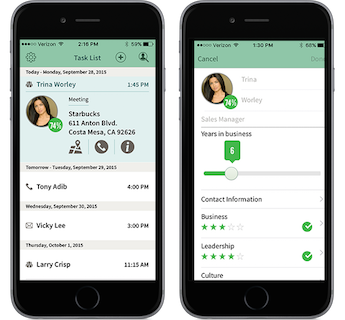

Model Match (Production Recruiting Software)

Model Match (Production Recruiting Software)

(949) 344-9407 ♦ ModelMatch.com

Why techies love you: Techies’ top five reasons for loving Model Match: Ease of use, configurable, cloud-based, dashboards, and pipeline management and forecasting.

Why clients love the company: Clients’ top three reasons for loving Model Match: Reinvigorated my recruiting, get more done in less time, and fantastic educational programs.

Description of products/services offered: Model Match will take you step-by-step through sourcing, attracting and hiring producers. Thanks to the company’s easy-to-follow recruiting methods, quick tips and contact management, they will help you become a recruiting superstar. A simple click and the Model Match engine will show you your highest priority candidates and where to best focus your recruiting efforts. The results … less time spent recruiting, higher quality candidates, stronger performance, longer retention and more time to attend to the rest of your business.

Secure Insight

Secure Insight

(877) 758-7878 ♦ SecureInsight.com

Why techies love you: A tech-driven data analytic vendor risk assessment tool with live monitoring.

Why clients love the company: Accurate, reliable and affordable risk management and consumer protection, 24/7.

Description of products/services offered: Closing Guard is Secure Insight’s “deep dive” settlement agent vetting tool that provides evaluation, monitoring, 24/7 reporting in a nationwide shared database.

Quick Check is a scaled down tool designed for wholesale lenders and warehouse banks, and can also be utilized to audit a lender's internal process. Once and done reports delivered within 24 hours.

Vendor Check is a comprehensive report on any third-party service provider other than settlement agents. Data is verified, evaluated and reported in an easy-to-read, one-page format.

TagQuest Inc.

TagQuest Inc.

(888) 717-8980 ♦ TagQuest.com

Why techies love you: TagQuest is quickly reacting to the ever-changing marketplace.

Why clients love the company: TagQuest is focus on the specific needs of each of its clients.

Description of products/services offered: TagQuest Inc. is a full-service marketing firm offering the most up-to-date, cutting-edge marketing solutions for the ever-changing mortgage industry. Tag Quest offers services like direct marketing, online marketing-social media-PPC-SEO, direct mail, data list acquisition and hygiene, live transfer leads, Internet leads, e-mail marketing, printing services, client tracking-follow up-retention, demographic analysis, telemarketing and much more.

Vantage Production LLC

Vantage Production LLC

(800) 963-1900 ♦ VantageProduction.com

Why techies love you: Vantage Production’s mortgage technology integrates with lender and partner platforms.

Why clients love the company: Clients love Vantage Production because they help their clientele increase sales and close more loans.

Description of products/services offered: Vantage Production LLC is the nation's leading innovator of mortgage-specific customer relationship management (CRM), automated marketing and marketing content, sales enablement, and MBS market advisory services. Vantage Production empowers lenders to create exceptional experiences for loan originators, borrowers and referral partners, while driving revenue, managing risk, building trust and ensuring compliance. To learn more about how Vantage Production is helping more than 300 leading lenders and tens of thousands of individual mortgage industry subscribers, visit VantageProduction.com.