CoreLogic: More Homeowners Are Paying Capital Gains Taxes

Nearly 8% of U.S. homes sold in 2023 exceeded the capital gains tax limit of $500,000.

The 2024 tax season ended last week, with the IRS expecting Americans to file more than 146 million returns. It is this time of the year that many homeowners who sold their properties during the previous year will enjoy a significant tax benefit on their homeownership investment.

Since 1997, homeowners can exclude housing capital gains for up to $500,000 (or $250,000 for a single filer) when they sell their houses. For anything below the exemption limit, homeowners do not even need to report the sale to the IRS.

CoreLogic says in its latest report that strong price growth during 2021 and 2022 is leading a growing number of homeowners to find for the first time that they may owe taxes on excess capital gains beyond the exemption limits, due to property values doubling, tripling or even quadrupling over the years since they bought the home.

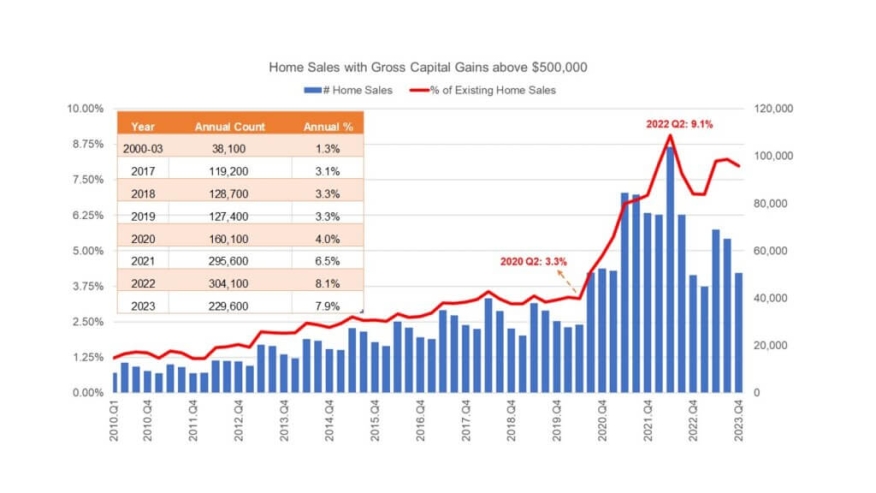

Between 2000 and 2003, a few years after the passage of The Taxpayer Relief Act of 1997, only about 38,000 home sales per year, or 1.3% of existing home sales, had gross capital gains that exceeded the exemption limit. From 2017 through 2019, numbers hovered at below 130,000 annually and represented about 3% of annual existing home sales.

However, in the peak year of 2022, more than 300,000 home sales had gross capital gains above the $500,000 exemption limit, a staggering 140% increase from pre-pandemic levels. In Q2 2022, when home price acceleration rose to the pandemic-cycle peak, sales of homes that exceeded the capital gains limit reached 9.1% of quarterly existing home sales.

In 2023, these sales dropped by 25% from 2022 to slightly shy of 230,000 but were up by 80% from 2019. At the end of 2023, home sales that required capital gains payments stood at 7.9%, 150% higher than the 2017-2019 average.

Between 2017 and 2023, California alone accounted for 37% of national sales that had gross capital gains beyond the exemption limit. During the same period, California’s overall existing home sales made up a much smaller portion (10%) of the national overall volume.

Five other expensive states accounted for 31% of sales nationwide that had gross capital gains above the exemption limit: New York, New Jersey, Massachusetts, Florida and Colorado. Along with California, these states had a total of 68% of national sales with gross capital gains above the exemption limit. CoreLogic says their combined overall existing home sales made up 35.5% of national sales between 2017 and 2023.