Renters Don't See Homeownership In Their Future

Redfin report shows less renter confidence from a year ago

Confidence among one particular group of prospective homebuyers has dropped by 11% over the last year.

That would be renters, of whom nearly two in five (38%) in the U.S. don’t believe they’ll ever own a home, according to Redfin. That’s up from roughly one-quarter (27%) less than a year ago, with a lack of affordability diminishing would-be borrowers’ hopes and dreams.

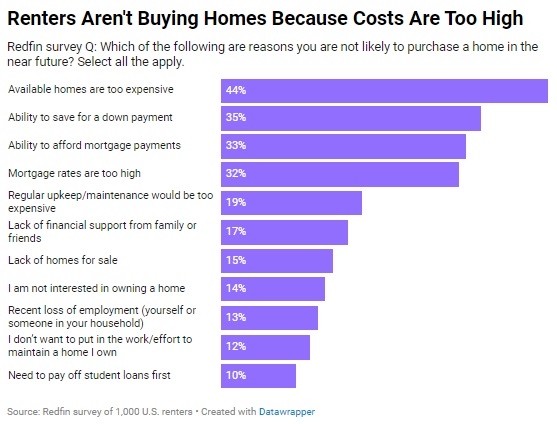

Nearly half (44%) of renters who don’t believe they’ll buy a home in the near future blame it on high prices, while 35% are unable to save for a down payment. Meanwhile, 33% are unable to afford mortgage payments and another 32% are fearful of high mortgage rates.

This trepidation is due to the fact that home prices have risen 7% in the last year alone, while monthly mortgage payments have risen more than 10%.

“Housing costs are high across the board, but renting is a more affordable and realistic option for many Americans right now—especially those who have never owned a home and aren’t able to tap into equity from a previous sale,” said Redfin Chief Economist Daryl Fairweather. “While owning a home is usually a sound long-term investment, the barriers to entry and upfront costs of buying are higher than renting. Buying typically requires a sizable down payment and approval for a mortgage—things that are difficult for many people today, when the typical down payment is near $60,000 and mortgage payments are sky-high. The sheer expense of purchasing a home is causing the American dream of homeownership to lose some of its shine.”

People born in the late 90s and early 2000s, known as Generation Z, are the most confident in their ability to become homeowners, Redfin reports. Just 8% of Gen Z renters believe they’ll never own a home, compared to 22% of millennials, 40% of Gen Xers and 81% of baby boomers.